Is a QLAC right for me?

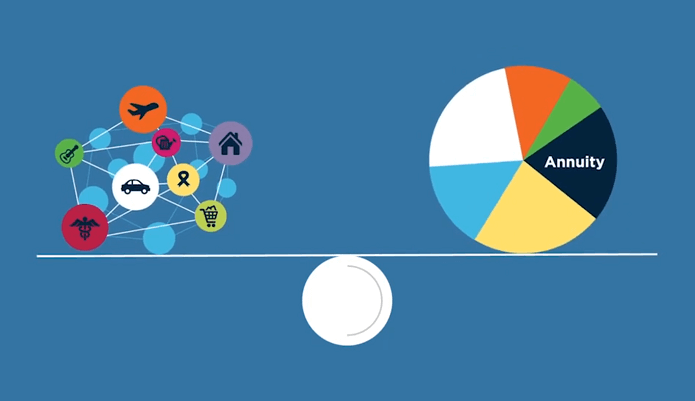

"Our powerful technology can help you handpick the right QLAC annuity to complement the rest of your asset allocation

If you're one of the many people looking to extend tax-deferral on your retirement plan assets, then a QLAC may be perfect for you. Leverage our thirty-years of experience along with the carefully executed features of our annuity screener application, and what used to take hours can now be reduced to minutes.

What you get…

Get big time selection at QLACRATES.COM

But first, let's make sure to identify exactly how much of your existing tax-qualified IRA assets you are eligible to contribute.

If you don’t want or need to take required minimum distributions from your retirement assets now, Qualified Longevity Annuity Contracts (QLAC) let you defer a portion of your RMDs up to age 85. There are many other reasons why a QLAC may be right for you, tell us what you think.

Start by using our calculator below to determine your QLAC eligible amount.

A QLAC can help you put money aside now so you can have a guaranteed, steady stream of income in the future…

QLACs offer consistent income for as long as you live1, without having to worry about market risk…

With a QLAC, you'll know up front exactly how much your income will be on the date you choose for payments to begin…

If your investments don't work out, a QLAC makes a paycheck available that otherwise would not have been there…

Total IRA Assets

Total QLACs Owned

QLAC Eligible Amount $0.00

smart

Designing a retirement strategy around principal and income protection1 is a smart move towards greater financial security.

- Jeffrey J. Hovermale Founder & CEO of Robo Advisor™

People simply love annuities…

" dollars' worth were bought over the last 10 years by folks just like you

N/A, U.S. Individual Annuities Survey - LIMRA Secure Retirement Institute,

People buy annuities for many reasons…

These are some of the most common ones

Need more income

Hey, just because you're retired doesn't mean you can't get a raise. Fixed interest & Immediate annuities can help optimize income from unproductive assets.

Leaving a legacy

You want to leave assets to your family without the expense & delay of probate? Fixed, Indexed and Index linked annuites avoid probate and pay to your loved ones in double time.

Predictable returns

Not swinging for the fences any longer? Then you probably prefer sensible, fair & predictable returns without market risk. Fixed interest annuities can give you exactly what you want.

Concerned about market risk

Your looking for growth on your assets, but you can't afford to risk losing your principal to get it. Indexed & Index Linked annuities are good options for growth potential with downside protections.

Working for the future

Your still working but your ready to start making plans for the income you want when retirement begins. Longevity annuities can help you have the amount at exactly the time you want it to begin.

Concerned about inflation

You can have annuity payments with automatic increase options built right in. Income & Longevity annuities can give you the choice of a yearly percentage increase or one based on the CPI.

We'd love to hear from you…

"Want to work with us, we've got you covered

We've made it more convenient than ever for you to reach out - chat, have a phone call, or schedule an online meeting. Start now and see the benefits you can get by working with one of our licensed annuity professionals.

Annuity Videos We Like

New to RoboAdvisor ?

According to the US Census, Florida ranks #3 for US states in total population. Comparatively speaking,

Total IRA Assets

Previous QLAC contributions

The first steps are to identify your existing tax-qualified retirement plan and IRA assets, and any QLAC contributions you made in previous years.

Eligible IRA accounts only include QLACs held under IRAs. Don’t include QLACs held under other qualified plans. Total the previous year 12/31 fair market value for all Traditional IRAs, SEP IRAs, Simple IRAs and QLAC IRAs and enter here.

QLAC Eligibility Rules

Previous QLAC contributions

Prior year QLAC contributions can also affect the amount of your eligible contribution.

The dollar limit applies across all qualified retirement plans and IRAs (excluding Roth and Inherited IRAs) collectively. The percentage limit applies to each qualified plan separately and to IRAs on an aggregate basis.

QLAC Eligible Amount

2025 maximum limited to $200,000

Your eligible contribution amount is the lesser of $200,000.

There are restrictions on how premium limit rules can be applied. There are also restrictions on how qualified plan assets can rollover to a QLAC. It’s your responsibility to ensure QLAC premium limitations are met. Roth IRAs and Inherited IRAs cannot be treated as a QLAC.